Strengthening Financial Resilience against Climate and Disaster Impacts: Key Insights from UR24

October 30, 2024 10:15 am Leave a comment

Strengthening Financial Resilience against Climate and Disaster Impacts: Key Insights from UR24

Original article published on the Financial Protection Forum

A joint reflection note by the World Bank’s Disaster Risk Financing and Insurance Program (DRFIP), Global Facility for Disaster Reduction and Recovery (GFDRR), Tokyo Disaster Risk Management Hub, and Southeast Asia Disaster Risk Insurance Facility (SEADRIF) on driving innovation in disaster risk solutions for a more secure future.

The Challenge

As natural disasters continue to escalate, governments and businesses around the world must brace themselves for their financial and economic impacts. Extreme natural disasters cost an average of $452 billion annually in economic losses. Governments are investing roughly $1 trillion annually into infrastructure, yet disaster-related impact to infrastructures presents a significant part of governments’ contingent liabilities.

Effective disaster risk financing and insurance (DRFI) is a critical tool in mitigating financial losses from the impacts of climate change and natural hazards. It encourages risk-based decision-making and the adoption of financial protection instruments, and builds more resilient systems for response and recovery.

World Bank Group’s Efforts in DRFI

The World Bank Group (WBG) supports client countries in developing and most importantly implementing robust DRFI strategies to enhance their resilience through the Disaster Risk Finance and Insurance Program, in collaboration with Global Facility for Disaster Reduction and Recovery (GFDRR) Japan-World Bank Program for Mainstreaming Disaster Risk Management in Developing Countries.

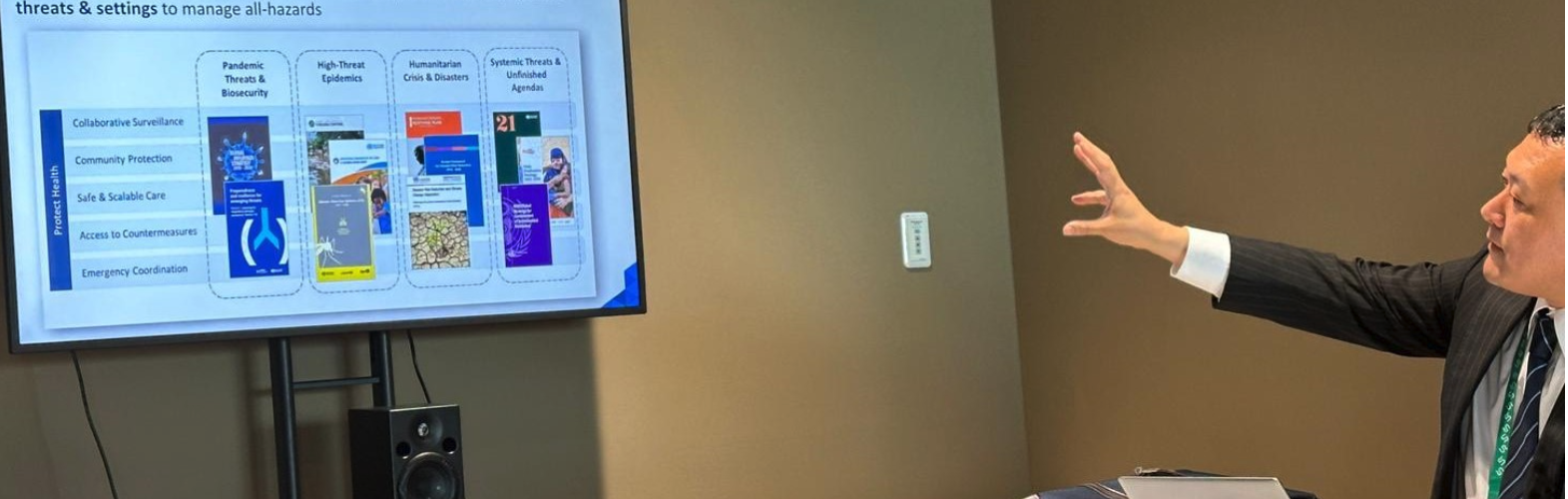

The Understanding Risk Global Forum 2024 (UR24)—organized by the GFDRR Tokyo Disaster Risk Management (DRM) Hub—has been the largest Understanding Risk Global Forum to date, with more than 1,700 attendees joining onsite in Himeji, Japan in June 2024. At UR24, leading experts discussed the latest in DRFI, focusing on innovations and strategies to advance global efforts in disaster and climate resilience. Here are some key insights on the frontiers of DRFI from the event, which can help global leaders and practitioners further advance their efforts.

1. Comprehensive financial protection strategies are needed to help countries close the protection gap and strengthen holistic resilience including in the infrastructure sector.

At the “Global Knowledge Exchange on DRFI for Resilient Infrastructure” session hosted by the WBG, in partnership with Asia-Pacific Economic Cooperation (APEC), Association of Southeast Asian Nations (ASEAN)+3 and Southeast Asia Disaster Risk Insurance Facility (SEADRIF), experts shared the latest approaches in integrating disaster risk considerations into asset management frameworks, especially for lifeline critical infrastructure, such as school buildings, health facilities, transport networks, and power systems.

- In Grenada, the disaster resilience strategy has evolved since the devastating impact of Hurricane Ivan in 2004. The country now has multiple layers of financial protection, including a contingency fund, a WBG facility, and insurance with the Caribbean Catastrophic Risk Insurance Facility (CCRIF).

- Morocco’s national strategy, which includes a solidarity fund supported by insurance premiums and a risk transfer strategy for major disasters like earthquakes, has been effective in providing quick payouts after events like the Al Haouz earthquake.

- The Philippines’ DRFI strategy, which includes risk retention mechanisms like national disaster funds and risk transfer mechanisms such as parametric insurance and catastrophe bonds, have been crucial in providing quick financial support during disasters. The country’s National Asset Registry System (NARS), a consolidated database of “non-financial critical and strategically important government assets”, enables long-term sustainable asset management through efficient financial risk management that enhances service delivery, and improves risk reduction for sustainability. Utilizing NARS, more than 130,000 schools are covered through the National Indemnity Insurance Program against fire and natural catastrophes.

- In the Marshall Islands, efforts are ongoing to modernize DRFI legislation, establish contingency funds, and seek international partnerships to enhance financial resilience.

- The Japan International Cooperation Agency highlighted the importance of combining disaster risk reduction with DRFI to invest in resilient infrastructure, presenting a case for integrated approaches to resilience building and stressed on the need for strong governance and institutional frameworks to support these initiatives.

- In line with its DRFI Strategy, Indonesia has embarked on a journey to establish its State Asset Insurance program as part of its risk transfer mechanisms for public assets. The program offers 10% of all insurable office, health and educational buildings with coverage against perils including fire, floods and earthquakes.

2. Pre-arranged finance for public assets plays a crucial role in managing governments’ disaster-related contingent liabilities.

- Linking financial preparedness with operational preparedness is crucial for building comprehensive disaster resilience, particularly in the context of public asset protection.

- Effective management of public assets involves assessing risks, ensuring resilience, and planning for contingencies. This approach not only safeguards critical infrastructure but also enhances overall disaster preparedness and response capabilities.

- The WBG is renewing its approach to knowledge, ensuring that the best global knowledge can help drive development, create scalable, replicable projects, and influence global conversations. As part of the WBG’s Knowledge Compact, a series of WBG resources like the “Financial Protection for Public Assets: A Practitioner’s Guide for Public Officials (2022)”, Financial Protection of Critical Infrastructure Services (2021)”, “Catastrophe Insurance Programs for Public Assets: Operational Framework (2020)” , and a simulation-based e-learning program on DRF provide practitioners with a comprehensive knowledge base for understanding financial protection measures. Analytical tools such as WBG’s Enabling Environment and Progress Assessment (EEPA) tool enable governments and stakeholders to make informed decisions regarding DRFI, asset management, and resilience-building initiatives.

3. Risk pools are a promising solution to help address the ever-widening insurance protection gap.

By aggregating risks across multiple countries in one region, regional risk pools, now available in the Caribbean, Africa, Pacific and Southeast Asia, enable countries to diversify their financial buffers and absorb shocks more effectively. However, there are challenges associated with designing innovative financing structures and ensuring sustainable implementation of risk pooling solutions. Dialogue between countries, regional risk pools, reinsurers, brokers, technology providers and development partners is crucial to foster an understanding of diverse perspectives, needs, and roles.

- Delegates from Grenada, a member of CCRIF SPC (formerly the Caribbean Catastrophe Risk Insurance Facility) -, shared their journey with their catastrophe insurance policy. While it hadn’t been triggered since its inception in 2007 the government continued to purchase the policy to ensure protection. Training provided by CCRIF SPC has enabled a shift from reliance on immediate assistance to a focus on risk management and resilience. In July 2024, Grenada received multiple payouts related to Tropical Cyclone Beryl from the CCRIF SPC including to their electric and water utilities. The total payout amounted to more than $50 million, demonstrating the real proof of the value of continued protection through disaster risk financing mechanisms.

- Delegates from St. Vincent and the Grenadines, Malawi, Tonga and Lao PDR shared their experiences of engaging stakeholders across ministry and local governments in tailoring insurance products to meet their unique needs.

- Regional risk pools offer significant benefits by reducing transaction costs, accessing centralized expertise, decreasing total premium costs through economies of scale, and diversifying risk. As regional sovereign risk insurance providers, CCRIF SPC, African Risk Capacity Limited (ARC Ltd.), Pacific Catastrophe Risk Insurance Company (PCRIC), and SEADRIF indicated that the design of business models to ensure sustainability, as well as ways of securing support for capital, premium subsidy, and technical assistance are areas requiring continuous improvement.

- Many countries in Southeast Asia face significant exposure to climate and disaster risks; however, the diversification of risk across these countries offers opportunities for more efficient financial protection. SEADRIF highlighted that a potential structure for joint protection against earthquakes could result in premiums being approximately 16% lower compared to countries purchasing coverage individually, purely due to the benefits of risk diversification. By creating a larger, more diversified portfolio and taking a collective approach to the insurance market, even greater savings could be realized, with estimated overall price reductions of up to 25%.

4. Data and analytics are crucial for enhancing risk assessment across all phases of disasters, including accurate risk evaluation, rapid response, and damage assessment.

However, challenges persist, such as data availability in low-to-middle income countries, alongside emerging opportunities facilitated by advancements in AI and open data platforms.

- In Morocco, satellite data and machine learning have been leveraged to minimize basis risks, allowing for parametric insurance, and actuarial modeling allows for quantification of the opportunity costs between diverse risk financing instruments. In the aftermath of the Al Haouz Earthquake in September 2023, the public mechanisms unlocked US$300 million and the losses were covered fully by risk pooling.

- Insights from Nanyang Technological University included those on the ASEAN Disaster Risk Financing and Insurance Phase 2 (ADRFI-2) platform which, in addition to making accessible hazard assessments for earthquake, flood and tropical cyclones, offers national and regional exposure, including exposure by-building utilizing high-resolution satellite imagery. Critical risk metrics for DRFI instrument design such as loss exceedances from Annual Average Loss to Probable Maximum Loss are also made available.

Many organizations are involved in the implementation of data and analytics for public benefit, but there is often limited coordination or exchange of information across stakeholders. Participants representing governments, regional risk pools, development institutions, academia, reinsurers, brokers, and technology providers all agreed that greater transparency is necessary in knowledge and information exchange to facilitate collaboration across organizations and regions in an effort to share best practices and common pitfalls.

5. Partnership and capacity building

Strengthening financial protection requires robust partnership at the local, regional and global levels to maximize reach, scale and impact. Comprehensive and effective DRFI strategies can be developed and implemented by leveraging the strengths and expertise of various stakeholders, including governments, international organizations, academia, think tanks, private sector entities, and civil society organizations. Partnerships ensure that DRFI approaches are not only robust but also contextually relevant, addressing the specific needs and challenges of different regions and communities. They foster innovation, resource mobilization, and knowledge sharing.

- APEC, ASEAN+3 and SEADRIF are examples of how regional-level partnerships can advance DRFI through enhancing regional cooperation and dialogue, pooling resources and expertise, strengthening financial resilience, and capacity building and knowledge sharing.

- Academia, such as Nanyang Technological University, and think tanks like the Global Asia Insurance Partnership (GAIP), bring specialized research and technical expertise to the development of innovative DRFI strategies, contributing to informed policy-making and the advancement of financial protection mechanisms.

- Japan has shown global leadership in elevating DRFI to the forefront of the development agenda. The Japan-World Bank Program for Mainstreaming Disaster Resilience in Developing Countries, managed by the Tokyo DRM Hub, has been supporting policy dialogues on DRFI in global and regional forums. DRFI in-country capacity building engagements supported by the Japan-World Bank Program have been instrumental in the design and implementation of risk financing strategies that help countries and regions better manage disaster risks, and safeguard critical infrastructure and public/private assets. Such activities have helped to develop the baseline for strategic plans for DRFI in Southeast Asia and the Pacific, provide an understanding of the enabling environment for DRFI in South Asia, and assess disaster related contingent liabilities in Latin America.

- Global partnerships also play a significant role in strengthening financial protection, and coordination between programs is essential to meet the increasing needs of client countries. The Risk Finance Umbrella (RFU) Program, which is managed by the World Bank and supported by key donors such as the Foreign Commonwealth and Development Office (FCDO), Swiss Secretariat for Economic Affairs (SECO), and the United States Agency for International Development (USAID), consolidates analytical and advisory activities to bolster financial resilience in low- and middle-income countries. The Global Shield Financing Facility (GSFF), which evolved from the Global Risk Finance Facility (GRiF) strengthens the financial resilience of countries and people by enabling design and implementation of financial solutions. The US$415m program financed by Canada, Germany, Luxembourg, UK, and Japan, complements the RFU and works downstream to co-finance World Bank lending Programs to put in place financial solutions, but also undertakes delivery of global engagements where there are knowledge and capacity gaps in the DRF landscape. As the global risk financing landscape evolves, together, the GSFF and RFU exemplify the importance of partnerships in achieving sustainable disaster risk financing.

The role of the private sector is critical in co-financing the cost of natural disasters and making risk transfer options available. Public sector stakeholders are increasingly tapping into private sector expertise to develop ways of managing their financial exposure to disaster risks. To strengthen this collaboration, communication and trust-building, as well as improving the volume and quality of data such as on hazard risks and assets is crucial.

- The Insurance Development Forum (IDF), represented by Tokio Marine, highlighted the importance of constantly upgrading risk assessment capabilities by showcasing successful partnerships between public and private sector stakeholders in Japan’s high-speed rail and offshore wind power projects.. This helps refine the allocation of risk bearing among relevant stakeholders.

Understanding complex risk financing concepts and insurance models can be challenging. During discussions at UR24, risk pools and their member countries emphasized the vital role of training, knowledge exchange, and effective communication to underscore the significance of insurance among diverse stakeholders and member countries.

To conclude, Global forums such as the Understanding Risk 2024 underscore the importance of robust disaster risk financing and insurance strategies in building financial resilience against climate and disaster impacts. By sharing innovative approaches and successful case studies, global leaders and practitioners can better navigate the complex disaster risk finance landscape and select options that are best suited for their needs. The WBG’s support in fostering regional partnerships, expanding the DRFI knowledge base, and leveraging data analytics remains vital in closing the financial protection gap amid more intense and frequent natural hazards.

気候変動と災害の影響に対する財務面のレジリエンスの強化:防災グローバルフォーラム2024 (UR24)からのインサイト

本記事は、世界銀行の災害リスクファイナンス・保険プログラム(DRFIP)、世界銀行防災グローバルファシリティ(GFDRR)東京防災ハブ(DRM Hub)、および東南アジア災害リスク保険ファシリティ(SEADRIF)によって共同執筆されました。原文(英語)はFinancial Protection Forumウェブサイトに掲載されており、こちらからアクセスいただけます。

課題

自然災害の頻発と規模の拡大に伴い、政府や企業はその財政的および経済的影響に対処するため、適切な備えが求められています。毎年、自然災害によって世界経済は平均4520億ドルの経済的損失を被っており、政府は毎年約1兆ドルをインフラ投資に充てていますが、災害によるインフラへの影響は政府の偶発債務の一部を占めています。

「過去40年間で自然災害によるコストは急増し、合計6兆ドルにも達しています。これは非常に深刻なグローバルな課題です。各国政府は、多岐に渡る開発目標達成に向けた施策を考慮しつつ、災害対応のためのリソースをどのように確保すべきでしょうか?」

今村英章 世界銀行日本代表理事

災害リスクファイナンスの重要性

効果的な災害リスクファイナンスおよび保険(Disaster Risk Finance and Insurance、 以下DRFI)は、気候変動や自然災害による経済的損失を軽減するための重要な手法の一つです。 DRFIは、リスクの理解に基づいた意思決定を促し、災害からの財政的影響を軽減する手段を検討することで、災害への対応・復旧システムが強化され、レジリエンスが高まります。

世界銀行グループの取り組み

世界銀行グループ(WBG)は、災害リスクファイナンス・保険プログラム(DRFIP)を通じて、防災グローバルファシリティ(Global Facility for Disaster Reduction and Recovery、以下GFDRR)、日本ー世界銀行防災共同プログラム(東京防災ハブ)と協力し、クライアント国が強固な災害リスクファイナンス戦略を策定し、その実施を支援しています。

GFDRR東京防災ハブが主催する「防災グローバルフォーラム2024(UR24)」は、2024年6月に日本の姫路で開催され、1,700人以上が参加し、DRFIの最新動向や、災害や気候変動に対する世界的なレジリエンスの向上に向けた戦略やイノベーションが議論されました。以下に、財政的レジリエンス強化に取り組む各国リーダーや実務者の参考となりうる、UR24を通じて得られたDRFIに関する主要なインサイトを紹介します。

- プロテクションギャップの解消とインフラのレジリエンス強化

世界で頻発する自然災害に伴うプロテクションギャップ(経済的損失と保険による補償額の差)を埋め、インフラ分野を含む包括的なレジリエンスを強化するためには、財政的な保護措置を戦略的に検討・実施することが重要です。

世界銀行グループがアジア太平洋経済協力(APEC)、東南アジア諸国連合(ASEAN)+3、東南アジア災害リスク保険ファシリティ(SEADRIF)と共同で開催した「レジリエントなインフラのための災害リスクファイナンスに関するグローバル・ナレッジ・エクスチェンジ」では、専門家が、特に学校、医療、交通、電力といった重要なライフラインインフラを対象に、資産管理の枠組みに災害リスクへの配慮を組み込むための最新の取り組みについて意見を交換しました。

- 国際協力機構(JICA)は、災害のリスクを軽減する取り組み(Disaster Risk

Reduction: DRR)とDRFIの統合的なアプローチの重要性を事例を紹介しながら強調しました。また、こうした取り組みを支える強固なガバナンスと制度的枠組みの重要性も指摘されました。

2. 公共資産の保護と災害からの偶発債務の管理

公共インフラ等の資産に対して、発災前に事前に復興資金を準備することは、政府の災害関連偶発債務の管理において重要な役割を果たします。

- 包括的な災害へのレジリエンスを構築するためには、財政的な備えと運用上の準備を一体化させることが不可欠です。特に公共資産の保護において、その重要性は一層高まります。

- 公共資産を効果的に管理するためには、リスクの評価、事前準備や防災活動、そして不測の事態への備えが重要です。

- 世界銀行グループは最先端の知見を活用して開発を推進し、拡張性と再現性のあるプロジェクトに取り組むことを通じて、国際社会での議論に参加し、財務的レジリエンス強化に貢献することを目指しています。例えば、Enabling Environment and Progress Assessment(EEPA)ツールなどの分析ツール等を開発・活用し、政府や関係者が災害リスクファイナンスや資産管理、レジリエンス構築に関する情報に基づいた意思決定を行うことを支援しています。

3. リスクプールによる財政的レジリエンスの強化

地域リスクプールは、プロテクションギャップを埋め、保険を通じた財政的な備えを強化する有力なソリューションの一つです。

カリブ海、アフリカ、太平洋、東南アジア地域で設立された地域リスクプール(Regional Risk Pools)は、地域内の複数の国がリスクを共有する保険の仕組みであり、各国が災害への財政的な対応策のオプションを多様化し、より効果的な災害への財政的な保護措置を可能とします。

- 地域リスクプールは、取引コストの削減、専門知識の集約、規模の経済による総保険料の削減、そしてリスク分散など、多くのメリットを提供しています。特に東南アジア諸国は、多様な気候変動や自然災害リスクにさらされており、リスクの分散を通じて、より効率的な財政的保護が実現可能です。SEADRIFは、地震リスクの共同保護構造により、個別に保険購入と比べて、保険料が約16%低くなる可能性があることを示しています。

4. データと分析の重要性

リスク評価の向上は、災害のあらゆる段階で不可欠であり、正確なリスク把握、迅速な対応、被害評価などにおいて、データと分析は重要な役割を果たします。AIやオープンデータプラットフォームの進展によって新たな機会が広がる一方で、中・低所得国では依然としてデータ入手が困難などの課題が残っています。

- 南洋理工大学 (NTU Singapore)からは、現在実施中のASEAN災害リスクファイナンス・保険プログラムフェーズ2(ADRFI-2)プラットフォームに関するインサイトが提供されました。このプラットフォームは、地震、洪水、熱帯低気圧に関する危険度を評価し、それに基づく高解像度の衛星画像を用いた建物ごとのリスク評価も行なっています。

- また、政府、地域リスクプール、国際開発金融機関、大学や研究機関、再保険会社、ブローカー、テクノロジープロバイダーなど、多くの組織が公共の利益のためにデータや分析の活用に取り組んでいます。しかし、知識や情報の共有において透明性を高める必要があることが、参加者の一致した意見として挙げられました。これにより、組織や地域を越えた協力が進み、ベストプラクティスや共通の失敗例等をもっと共有していくことが求められています。

5. パートナーシップと能力強化

財政的な保護措置を強化するには、地域、国家、国際レベルでの強固なパートナーシップを構築し、その範囲、規模、影響力を最大限に広げることが、DRFIの効果を高める鍵となります。政府、国際機関、学術機関、シンクタンク、民間セクター、市民社会組織など、多様なステークホルダーの専門性や強みを活かして、包括的かつ実効性のある戦略を策定し、実行することが求められます。

- 日本は、災害リスクファイナンスを開発アジェンダの優先事項に位置付け、国際的なリーダーシップを発揮してきました。東京防災ハブが事務局を務める「日本―世界銀行防災共同プログラム」は、世界および地域ごとのフォーラムでの政策対話を支援しており、各国が災害リスクをより適切に管理し、重要なインフラや公共・民間資産の保護を強化するための戦略策定と実行に貢献しています。このような活動は、東南アジアおよび太平洋地域におけるDRFIの戦略策定や、南アジアにおけるリスクファイナンス環境の理解、さらにはラテンアメリカにおける災害関連偶発債務の評価にも寄与しています。

さらに、グローバルなパートナーシップも、財政的な保護措置の強化において重要な役割を果たしており、プログラム間の連携が進むことで、各国のニーズに応じた対応が可能となります。世界銀行が運営するリスクファイナンス・アンブレラ(RFU)プログラムは、英国外務・英連邦・開発省(FCDO)、スイス経済省経済事務局(SECO)、米国国際開発庁(USAID)などのドナー国からの支援を受け、低・中所得国の財政的レジリエンスを強化するための分析や助言を提供しています。さらに、グローバル・リスク・ファイナンス・ファシリティ(GRiF)から発展したグローバル・シールド・ファイナンス・ファシリティ(GSFF)は、金融ソリューションの設計と実施を支援し、各国の財務的レジリエンスを向上させる取組を強化しています。カナダ、ドイツ、ルクセンブルク、英国、日本が資金提供する4億1500万米ドルのプログラムは、RFUを補完し、世界銀行の融資プログラムに共同出資することで金融ソリューションを導入するだけでなく、DRFの状況において知識やスキルの向上が必要な分野でのグローバルな取り組みの支援も行います。

- 民間セクターの役割も、自然災害のコストを分担し、リスクの移転の選択肢を提供するうえで大変重要です。公共セクターでは、災害リスクに対する財務的エクスポージャーを管理するために、ますます民間セクターの専門知識を活用する関心や傾向が強まっています。

- 保険開発フォーラム(IDF)(代表:東京海上日動火災保険株式会社)は、日本の新幹線や洋上風力発電プロジェクトにおける成功事例を紹介し、官民連携がリスク評価能力の向上に寄与することや、関係者間のリスク分担がより効果的に行われることが可能となること等を強調しました。

- リスクファイナンスという概念や保険モデルの複雑さを理解するのは簡単ではない中で、UR24の多くの議論では、リスクプールやその加盟国が、多様なステークホルダーや加盟国に対して保険の重要性を訴えるために、研修や知識の共有、効果的なコミュニケーションが重要であることが強調されました。

結論として、UR24のようなグローバルフォーラムでは、気候変動や災害の影響に対する財務的レジリエンスの構築において、強固なDRFI戦略の重要性が多様な議論や視点から明らかになりました。先進的な手法や成功事例を共有することで、世界のリーダーや実務者は複雑な災害リスクファイナンスの状況をより的確に理解し、自国のニーズに最も適した選択肢を選ぶことができるようになります。自然災害がますます激化し頻繁になる中、自然災害からのプロテクションギャップを埋めるためには、地域的なパートナーシップの促進、DRFIの知識基盤の拡大、そしてデータ分析の活用が重要であり、これらの領域において世界銀行グループの支援が引き続き重要となります。

(L) Learning about castle stone wall restoration and management; (R) Ahmed Eiweida, World Bank Global Coordinator for Cultural Heritage and Sustainable Tourism, at Himeji Castle.

(L) Learning about castle stone wall restoration and management; (R) Ahmed Eiweida, World Bank Global Coordinator for Cultural Heritage and Sustainable Tourism, at Himeji Castle.